E-filing Form 2290 Is Now Available for the 2023-2024 Tax Year!

FILING 2023-2024 FORM 2290 IN ADVANCE

Get more time to pay your HVUT and Get Schedule 1 immediately after the IRS opens filing.

Now Accepting Form 2290 for the 2023-2024 Tax Period. File Now and Get your Stamped Schedule 1 in Minutes. E-file Form 2290 Now

Filing 2290 in Advance with IRS Authorized Provider

We are the only IRS-authorized E-filing service provider offering an advance filing of 2290 form for each tax year. Beginning May 1, 2023, the option to file your 2290 Form for the 2023-2024 tax year will be available exclusively for all truckers. Because everything we do, we do with you in mind!

TYPICALLY, THE RENEWAL PERIOD FOR HVUT OPENS ON JULY 1, BUT NOW WITH ADVANCE FILING, YOU CAN BEGIN FILING YOUR 2290 AS EARLY AS

MAY 1,2023.

Because we help you get taxes out of the way so that you can get back on the road!

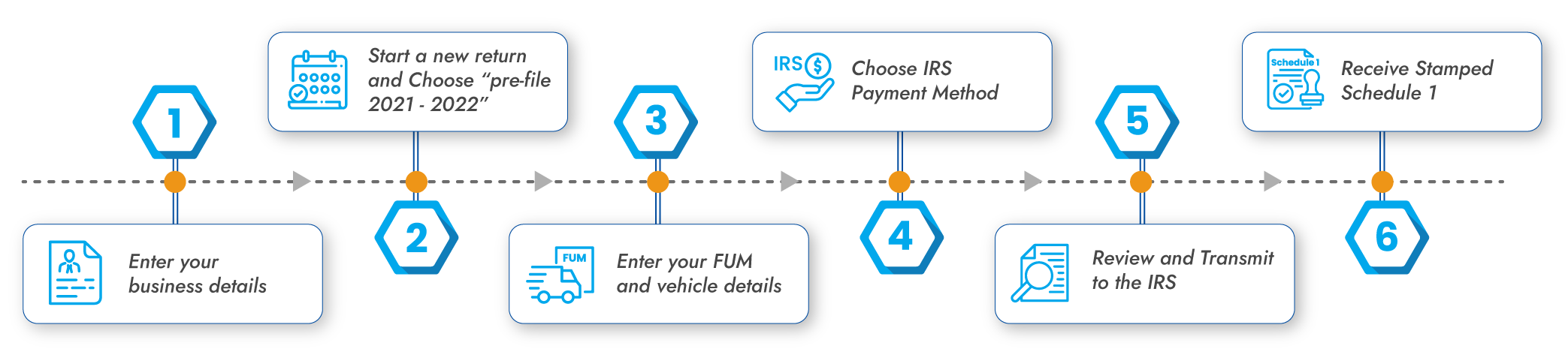

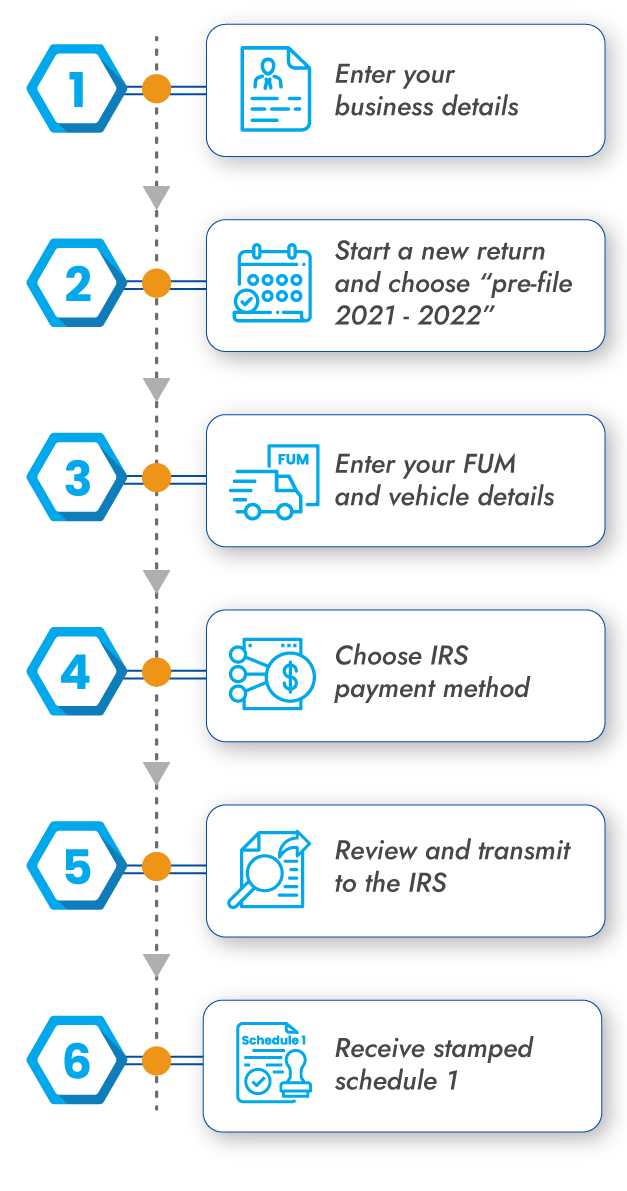

HOW TO FILE FORM 2290 FOR 2023-2024 TAX YEAR?

We will transmit the returns for you once the IRS begins accepting Form 2290 for 2023-2024 tax Period on July 1, 2023. You will get the schedule 1 immediately by July 1, 2023 through your registered email.

Get Started Now and File your Form 2290 Early for 2023-2024 Tax Period!

HOW DOES ADVANCE FILING WORKS?

ADVANCE FILING WORKS THE SAME WAY THAT E-FILING DOES FOR THE REGULAR TAX YEAR, BUT EARLIER!

Instead of filing in July like everyone else, you can file now in advance. Filing your 2023-2024 Form 2290 prior in May gives you an extra month to prepare and pay your Heavy Vehicle Use Tax! This way, you can find out how much you owe and begin saving money to pay your taxes by the deadline. Also you will get your schedule 1 (Form 2290) immediately after IRS started accepting the filing for the 2023-2024 tax period.

Our support team will be able to give you the time and help you need to file your 2290 form in advance without a hitch!

IT'S THE BEST OF BOTH WORLDS! YOU GET YOUR FILING OUT OF THE WAY, BUT CAN CONTINUE TO SAVE UP, FOR PRACTICALLY 2 MONTHS, BEFORE YOUR TAX IS DUE!

Why should I file 2290 in Advance?

File today and get your stamped Schedule 1 back on July 1, 2023

File now and pay your HVUT on or before

August 31, 2023

Avoid the rush of peak season and get your Schedule 1 fast

More time to make corrections on your

2290 if any

Avoid the risk of being penalized for not having your Schedule 1

Get expert help through chat, email, or phone without the wait

When is Form 2290 Filing due?

IRS Form 2290 is the tax form for Heavy Vehicle Use Tax and it must be filed annually by those who having heavy highway motor vehicle with a gross weight of 55,000

pounds or more.

The HVUT renewal period is typically from July 1 until August 31 each year. But for this 2023-2024 tax period, August 31st, 2023 will be the deadline for filing Form 2290.

At Advancefiling2290.com, we've extended that renewal period for you by a whole month! Now you can file your 2290 Form electronically beginning June 1 and pay the taxes all the way until the deadline.

FAQs on Advance filing

A: No, when you advance file with advancefiling2290.com, it costs the same as it would if you were e-filing normally. For a single truck filing, the fee starts at just $14.90, which is still the best value in the industry.

A: No, the first-used month of your vehicle remains the same regardless of when you file. If you're advance filing your renewal for the upcoming tax year 2023-2024, then your first-used month is July.

A: Nope! That's one of the best things about advance filing with advancefiling2290.com! You can e-file now, but you don't have to pay until the end of the tax season on August 31st 2023! That way you have plenty of time to save up and pay your taxes.

A: After you advance file, you will receive your Stamped Schedule 1 on July 1 when we transmit your return to the IRS. No muss, no fuss, no waiting. Get your proof of filing before HVUT tax season is in full force, and before everyone else!

ADVANCEFILING2290 Customer Support

We have a fantastic support team all year round that knows the trucking industry inside and out. We believe in being able to provide you with the best customer support both during the tax season and the rest of the year!

You can call us at 704.234.6005 from 9AM-6PM EST on Monday-Friday.

You can call us at 704.234.6005 from 9AM-6PM EST on Monday-Friday.  You can even chat with us on our website and have us walk you through the E-filing process from start to finish!

You can even chat with us on our website and have us walk you through the E-filing process from start to finish! You can e-mail us at support@expresstrucktax.com for 24/7 support in both English and Spanish.

You can e-mail us at support@expresstrucktax.com for 24/7 support in both English and Spanish.